New!

- Credit limit up to $20,000

- Interest only charged on what you use

- Withdraw any amount from $100

- Deposited to your bank account

New!

The Virtual

Credit Account

- Credit limit up to $20,000

- Tap n Pay or shop online interest-free

- Withdraw money to your bank

- Easy fortnightly or monthly payments

- From $5,000 to $50,000

- Fixed term. No early exit fees.

- Fast and easy, quick decision online

- Convenient, straight to your bank

Success!

Success!

Your information is safe

We take a 90-day snapshot of your bank statements

No person has access to your bank account

We're connecting with your bank...

This may take up to 60 seconds

We’ve just sent

to your account

Close

Your requested amount is greater than your current credit limit.

Close

Be confident

knowing we’ve got

you covered 24/7

- Credit limit up to $20,000

- Withdraw any amount over $100

- Cash sent straight to your account

Update credit limit

Select new credit limit

Your annual fee is

Request submitted

We'll get back to you with

an outcome real soon

Close

Update your credit

limit amount

Your Credit Limit

Credit limit updated

You’ve successfully increased your credit

limit from to and your annual

fee has been increased by >$4.42 monthly

Close

Request unsuccessful

Unfortunately your request to increase your credit limit has been unsuccessful. You'll be eligible to request an increased credit limit in 30 days

Outstanding balance

You’re unable to reduce your credit limit below your outstanding balance

Request pending

You currently have a credit limit request which is under review. You'll get an outcome shortly.

Cancel request

You’re request to update your credit limit

to will be cancelled.

Are you sure?

Credit limit updated!

Your credit limit request has been updated to . We've sent an email confirming the details.

Request unavailable

You're unable to update your

credit limit for another days.

Please read

Based on your application so far, you’re eligible to apply for a credit limit of

Do you still wish to continue?

It appears like you are trying to use a new bank account.

Do you still wish to continue?

Please read

Based on your application so far, you’re eligible to apply for a credit limit of

Do you still wish to continue?

Please confirm

your application. Do you have another

bank with transaction history?

Please confirm

Can you please confirm if this is correct?

Your living situation

rental/current living situation

Please confirm

your application. Do you have another

bank with transaction history?

Please confirm

Can you please confirm if this is correct?

Your living situation

rental/current living situation

Important note

Please note that to afford to repay this loan, you will need to reduce your discretionary spending. We have assumed that reducing your discretionary spending to obtain this loan meets your requirements and objectives. If it does not, you should not proceed with the loan. If you are unsure, you can contact us on 1300 669 059

Repayment schedule

You have no cleared transactions

Loading

Loading

Terms & Conditions

The AUD$250 credit back offer is available for a limited time only when you apply and are approved for a new Freestyle Virtual Credit Account from 1st of September 2020 and spend A$1,000 on eligible purchases within 12 months of card approval. Eligible purchases do not include fees, cash, cash equivalent transactions or illegal transactions, payments to charities, social service and government agencies, payments for proprietaries and sundries, streaming subscriptions, reoccurring payments or memberships, gambling, adult dating or escort services and refunds debited from the Freestyle Virtual Credit Account. The A$250 credit back will be paid as a statement credit to your respective Freestyle Virtual Credit Account within 3 days of meeting minimum spend criteria. Existing Freestyle customers who currently hold a Freestyle Virtual Credit Account, are not eligible for this offer. The credit back offer is limited to $250 per customer.

Close

Payment

unsuccessful

Get in touch with for

alternative payment options

Payment

successful!

Tap anywhere to continue

Repayment schedule

You have no cleared transactions

Loading

Loading

What’s next?

We are currently reviewing your application. If you’re approved, we’ll send the funds straight to your account

Scan QR code to download app

Equifax Verification

Exchange®

So that my application can be assessed, I consent to you and your service provider, Equifax Verification Exchange®:

-

collecting, using and disclosing my personal information to my employers (or to payroll or other service providers who might act on behalf of my employers) to identify me; and

-

collecting and using my employment income, history and related information from such parties to allow you to verify those matters.

*The $250 credit back offer is available when you apply and are approved for a new Freestyle Virtual Credit Account (Account) from 23rd March 2022 to 1st May 2022 (inclusive). If you redeem any part of the $250 credit back and then close your account within the first 6 months after opening it, MONEYME may charge an account closure fee of $150. Applications will be subject to our credit assessment and approval process. The Account may not be used for recurring payments or memberships. The $250 credit back will be paid as a statement credit to your Account within 3 days of meeting minimum spend criteria. Existing Freestyle customers who currently hold an Account are not eligible for this offer. The credit back offer is limited to $250 per customer.

Award-winning lender

Your debit card

Send a message

Please input your full name

Please input your email

Please input your query

Your debit card

Please input valid card number

Please input a valid expiry date. (e.g 01/2020)

Please input valid CVV

Please input your name on card

Thanks for your query

Unexpected error encountered!

Try again later or give us a call at 1300-66-90-59 anytime during business hours.

Loan reason

Please select at least one

-

It may be useful to talk to your utility provider and see if you can work out a payment plan with them.

-

It may be useful to talk to your council, water provider or body corporate and see if you can work out a payment plan with them.

-

It may be useful to talk to your credit provider and see if you can work out a payment plan with them.

-

A short-term loan is a small amount loan of $2,000 or less that is to be repaid between 16 days and 1 year

-

You have selected your loan purpose as other. We are unable to proceed with your application.

Privacy Consent and

Electronic Authorisation

By agreeing to this Privacy Consent and Electronic Authorisation, you consent to MoneyMe Financial Group Pty Ltd ACN 163 691 236, Australian credit licence number 442218, trading as MoneyMe (hereafter we, us or our), our related bodies corporate, affiliates and agents collecting, using, holding and disclosing personal information (including sensitive information) and credit-related information about you. You can find out more about how we deal with your privacy and the personal information (including sensitive information) and credit-related information that we hold about you by viewing our Privacy and Credit Reporting Policy.

Our Privacy and Credit Reporting Policy (Privacy Policy) contains information about how you may access or seek correction of your personal information and credit-related information, how that information is managed, how you may complain about a breach of your privacy, and how that complaint will be dealt with. It also contains information on ‘notifiable matters’, including things such as the information we use to assess your creditworthiness, the fact that credit reporting bodies may provide your personal information and credit-related information to credit providers to assist in an assessment of your credit worthiness, what happens if you fail to meet your credit obligations or commit a serious credit infringement (including our right to report a default or a serious credit infringement to credit reporting bodies), your right to request that credit reporting bodies not use your credit-related information for the purposes of pre-screening credit offers, and your right to request a credit reporting bodies not to use or disclose credit-related information about you if you believe you are a victim of fraud. You may request to have these notifiable matters (and our Privacy Policy) provided to you in an alternative form, such as a hard copy.

1. What is Personal Information?

The Privacy Act 1988 (Cth) defines “personal information” as information or an opinion about an identified individual, or an individual who is reasonably identifiable whether the information or opinion is true or not and whether the information or opinion is recorded in a material form or not. The kinds of personal information we may collect about you include your name, date of birth, address, account details, occupation, and any other information we may need to identify you, including publicly available information from public registers and social media. If you are applying for credit, we may also collect the number and ages of your dependants and cohabitants, the length of time at your current address, your employment details, and proof of earnings and expenses.

Sensitive information is personal information that includes information relating to your racial or ethnic origin, political persuasion, memberships in trade or professional associations or trade unions, sexual preferences, criminal record, or health.

“Credit information” means information about you such as your identity information, repayment history, the type and amount of credit provided to you, default and payment information, personal insolvency, court proceedings and any other publicly available information that relates to your credit worthiness. “Credit reporting information” is any personal information derived by a credit reporting body from credit information held about you bearing on your credit worthiness. Credit information and credit reporting information are, together, “credit-related information”.

2. Why Do We Collect Personal Information?

We may collect, use, hold and disclose personal information and credit-related information about you for the purposes of:

- fulfilling our functions and responsibilities under, and facilitating compliance with, the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth), the Anti-Money Laundering and Counter-Terrorism Financing Rules and the Corporations Act 2001 (Cth) and associated regulations (which require and authorise us to collect certain information), including to maintain regulatory and corporate records;

- providing you with consumer credit and managing that credit, including accepting, assessing and processing your application for a loan, undertaking risk assessments involving credit scoring, identity verification and fraud prevention and performing collections activities;

- managing our relationship with you and allowing us to perform administrative tasks;

- communicating with you about our products and services, including direct marketing of products, new products and services offered by us;

- undertaking quality assurance and audit activities to manage and assess our services and products; and

- providing information to third parties as authorised or required by law.

We may collect, use, hold and disclose your sensitive information (particularly your health information) if it is reasonably necessary for the type of credit we are providing you with. For example, if you submit an application with us to finance a medical procedure, we may collect your health information for the purpose of assessing your application and may disclose this health information to your surgery provider.

Your information will be collected and held by us and some of our third party service providers so that we can provide you with a range of services. In some cases, we may receive your personal information or credit-related information from a third party (for example, when we electronically verify your identity with third party providers).

3. What If We Didn't Collect Personal Information?

Without your personal information and credit-related information, we may not be able to process your application for a consumer credit, respond to your requests, perform our functions or provide you with some or all of our products and services.

4. Who Can We Disclose Your Personal Information To?

Your personal information may be provided to:

- credit reporting bodies to obtain a credit report for the purpose of assessing your loan application and managing the consumer credit provided. Information we disclose may include that you have applied for a loan, the amount of the loan, our status as your credit provider, payments that have been made on time, payments that are overdue, payments that are no longer overdue, when you are in financial hardship, when a serious credit infringement has been committed, or that the full amount of your loan has been paid (or your loan has been otherwise discharged). The information we exchange with credit reporting bodies may be included in reports that the credit reporting bodies give other organisations (such as other lenders) to help them assess your credit worthiness. Some of the information may adversely affect your credit worthiness (for example, if you have defaulted on your loan) and, accordingly, may affect your ability to obtain credit from other lenders;

- third party service providers to verify your identity against the information held on your credit file and to obtain your banking transaction history. We will engage with relevant registries using third party systems to match details contained in your Australian passport, driver licence, Medicare card, birth certificate and any other identification documents you provide us. We will also obtain the last 90 days of bank statements from your account for the purpose of assessing your loan application;

- any persons who represent you, including your finance broker, legal and financial advisers or personal and business referees;

- your employers, or payroll or other service providers who might act on behalf of your employers, to verify your identity and collect your employment and income history and related information from such parties to allow us to verify your employment and income (these checks will be performed in accordance with the Equifax Verification Exchange Privacy Collection Statement );

- Government entities such as Centrelink, the Australian Financial Complaints Authority, AUSTRAC, the Australian Taxation Office or other government departments, agencies or bodies and overseas regulators (if required);

- third party service providers to obtain personal information about you under the Freedom of Information Act from any motor vehicle or driver licence registry in Australia while any liability is outstanding to us, without reference to you;

- any investors, agents or advisers, trustees, ratings agency or businesses assisting us with funding for credit made available to you, or any entity that has an interest in your finance or our business;

- our related bodies corporate, subsidiaries, professional advisers, financiers, financial institutions, auditors, associates, debt collectors, contractors (including any of our overseas associates who may assist us in providing our products and services to you);

- other credit licensees (who may be a related body corporate of ours, such as SocietyOne Australia Pty Ltd or Broker Services Pty Ltd), including other credit providers, credit assistance providers or lead providers) where we are unable to assist you or consider you may need credit assistance in respect of other consumer credit options available. In this instance, you agree we may disclose your personal information to other credit licensees (who may pay us a fee for referring you to them, though this fee will not be passed onto you) who may either provide a service to you or refer you onto another credit licensee;

- any person considering acquiring an interest in our business or assets;

- other financial institutions – for example, to process a claim for mistaken payment;

- related bodies corporate or associated businesses that may want to market products to you;

- any of our associates, related bodies corporate or contractors such as claims related providers, including assessors and investigators that help us with claims; and

- any person where we are authorised to do so by law, such as under the Anti-Money Laundering and Counter Terrorism Financing Act 2006 (Cth) or by government and law enforcement agencies or regulators.

5. Overseas Disclosure

We may disclose your personal information and credit-related information to overseas entities, including related entities and service providers located overseas in New Zealand, USA, Canada, India, Ireland, the United Kingdom or the Philippines. Overseas entities may be required to disclose information to relevant foreign authorities under a foreign law. More information on overseas disclosure may be found in the entities’ privacy policies.

6. Verification of Identity

We may disclose your name, residential address and date of birth to an organisation, including a credit reporting body or other organisation (including the document issuer or official records holder via third party systems and services), to verify your identity. The organisation will use this information to give us an assessment/ report of whether or not the information we have matches information held by the organisation. If we use these methods and are unable to verify your identity in this way, we will let you know. We may also use information about your Australian Passport, state or territory driver licence, Medicare card, citizenship certificate, birth certificate and any other identification documents to match those details with the relevant registries using third party systems and to record the results of that matching. Note: If you do not provide this consent, we will verify your identity in another way, which may require you to provide various supporting identification documents (either original or certified copies).

7. Electronic Authorisation

You consent to receiving notices and other documents electronically or via the member log-in area via our website. You agree that by giving this consent:

- we will not send paper copies of notices and other documents to you unless required by law;

- you must regularly check your nominated email address for notices and other documents;

- we will either make all notices and other documents available for a reasonable period of time in the members log-in area on our website for retrieval by you, or we will send you such documents electronically; and

- you may withdraw your consent to the giving of notices and other documents by electronic means at any time provided that you submit an alternative method for us to communicate with you.

8. Your Consent

By clicking ‘Next’, you confirm that you:

- have read and understood this Privacy Consent and Electronic Authorisation; and

- consent to MoneyMe collecting, using, holding and disclosing your personal information and credit-related information in accordance with these terms;

- consent to receiving notices and other documents electronically or via the member log-in area via our website; and

- consent to the disclosure of your name, residential address and date of birth to a credit reporting body or other organisation (including the document issuer or official records holder via third party systems and services) for the purposes of electronically verifying your identity as set out above.

Please confirm

You selected that your future circumstances and financial position may change.

Can you confirm if you are

able to repay this loan?

Terms of use

User Terms and Conditions

Last Update: June 2021

ILLION OPEN DATA SOLUTIONS END USER TERMS

This End User Agreement (Agreement) is a legal agreement between illion (“illion”, “we” or “us”) and the End User of our Services (“End User” “you”, “your”). You are bound by this Agreement from the date you click "I Accept" “I Agree” or any other similar form for acceptance including when you access or use your Service Provider’s application or service. If you do not agree to this End User Agreement, you should not accept this End User Agreement and stop accessing or using your Service Provider’s application or service. If you agree to these terms on behalf of an entity, including but not limited to a company or other organisation, you represent and warrant that you have the power and authority to: enter into this Agreement; bind such entity; and act on behalf of the entity. Terms of this Agreement may be amended from time to time in accordance with clause 8.1.

This Agreement does not apply to the services that illion provides to Service Providers, those services are covered by a separate agreement between illion and Service Provider.

- DEFINITIONS

1.1 Account Information – means and includes personal information such as:

(a) account name/s;

(b) addresses;

(c) account details;

(d) account balances;

(e) credit limits;

(f) transaction details; or

(g) details of benefits / grants or subsidies provided to you

1.2 Credentials means your account login and password.

1.3 End User means an individual who wishes to share their Account Information with their Service Provider using Services provided by illion.

1.4 illion means illion Open Data Solutions Pty Ltd ACN 166 277 845 (an illion company) and also (a) illion Australia Pty Ltd (ABN 95 006 399 677) where you are accessing the Services via a ".com.au" Website, or (b) illion New Zealand Marketing Services Limited (Co. No. 6398759) where you are accessing the Services via a ".co.nz" Website.

1.5 Online Account means and includes your account held with a bank, credit union, financial services provider or any on-line portal (such as MyGov or reward platform) in Australia and/or New Zealand.

1.6 Privacy Policy means illion’s Privacy Policy (as amended from time to time) available on our website.

1.7 Services means and includes, services that we provide to the Service Provider such as:

(a) account verification (i.e. to supply the name an account is held in to show ownership);

(b) income and expense information;

(c) transaction categorisation; and/or

(d) a score based on transaction information.

1.8 Service Provider means and includes any third party nominated by you who is sent the Account Information on your behalf subject to the Authorisation provided by you in accordance with this Agreement.

- ABOUT THE SERVICES

2.1 This Agreement only applies when

(a) you authorise us to automatically retrieve your Account Information from your Online Account; and

(b) we supply the Account Information to a Service Provider in accordance with your authorisation (Authorisation).

2.2 Our Services are accessible via our Websites (https://www.bankstatements.com.au and illion.com.au in Australia, and https://www.bankstatements.co.nz and illion.co.nz in New Zealand), or through an Application Programming Interface (“API”) specifically created for this purpose in conjunction with your Service Provider.

2.3 In order to provide the Services, we require your consent which is obtained when you provide your Credentials, accept the terms of this Agreement and request your Account Information to be supplied to your Service provider.

2.4 Depending upon the terms of the agreement between you and your Service Provider you may access our Services either Manually (by you uploading a PDF copy of your account statements for processing by us) on our Website or Automatically (by you providing access to your Account Information via a secure API created for this purpose) in accordance with your authorisation as outlined in clause 2.5

2.5 Where the Services are accessed Automatically you understand and agree that:

(a) the Authorisation that you provide to the Service Provider can either be for:

(i) a single use – which allows us to complete a one-time retrieval of your Account Information using your Credentials to provide the Services. Your Account Information is encrypted and passed on to the Service Provider and subsequently discarded once no longer required, your Credentials are never retained.; or

(ii) an ongoing use – this requires us to retain and use your Credentials to access your Account Information on an ongoing basis to provide the Services to your Service Provider.

(b) Credentials are encrypted and only accessed when allowing the Account Information to be retrieved and passed to your Service Provider in accordance with your agreement with your Service Provider and this Agreement.

2.6 By agreeing to the terms of this Agreement, you authorise us to:

(a) access the Account Information from your Online Account, on your behalf using your Credentials (and you appoint us as your agents for that limited purpose);

(b) use your Account Information to provide the Services; and

(c) transmit the Account Information to the Service Provider as per the Authorisations provided by you.

2.7 While we have set out how we use your personal information in our Privacy Policy we note that we use your depersonalised information in aggregation for:

(a) developing and refining transaction classifications; and

(b) for building and supply of commercial insights for publication and supplying to our commercial partners; This information does not allow any party to identify you.

2.8 You understand and acknowledge that your Authorisation:

(a) under clause 2.5(a)(i) for single use will lapse as soon the Services are delivered to the Service Provider;

(b) under clause 2.5(a)(ii) for ongoing access will allow the Services to continue to be provided until:

(i) you change your Credentials, this will prevent the Service Provider from being able to access your Account Information (unless you reinstate the Agreement including supplying your new Credentials); or

(ii) u terminate your agreement with your Service Provider.

2.9 We will not charge you for our Services although you may be charged by your Service Provider in accordance with the terms which you agree with them

- TERM & ELIGIBILITY

3.1 Your Service Provider’s access to the Services continues until you cancel, or the Services are suspended or terminated in accordance with clause 8.

3.2 To be eligible to use our Services you must be 18 years of age or older.

3.3 You must register for the Service in your personal capacity, and not on behalf of any other person (except where you register on behalf of a company, in which case you warrant you are the authorised to do so).

- LICENCE

4.1 We grant you a non-exclusive, non-transferable, non-sublicensable, royalty-free, limited licence to access and use the Services (via the Website and or API as the case may be) for your personal use for the purpose set out in, and in in accordance with the terms of this Agreement.

4.2 You must not:

(a) cause or permit the reverse engineering, modification, disassembly or decompilation of the Services or any software forming part of it;

(b) copy, distribute, transmit, display, reproduce, publish, sub-license, create derivative works from, transfer, or sell or re-sell the Services or any information, software, products, or services obtained from or through the Website;

(c) manipulate the Services in a manner that would lead to inaccurate, misleading or discriminating presentation of information being displayed;

(d) do anything that compromises the security and/or stability of the Services, or interferes with or inhibits any other user of the Services;

(e) use the Services to send unsolicited email messages;

(f) attempt to or tamper with, hinder or modify the Services or attempt to or knowingly transmit viruses, malicious or harmful code or other disabling features to the Services or via the Services;

(g) use our Services in any way that competes with our business.

4.3 You must not use the Services for any activities, or to post or transmit any material, that:

(a) would cause you or us to breach any law, regulation, rule, code or other legal obligation (including any privacy law or intellectual property right);

(b) defames, harasses, threatens, menaces, offends or restricts any person;

(c) is or could reasonably be considered to be obscene, inappropriate, defamatory, disparaging, indecent, seditious, offensive, pornographic, threatening, abusive, liable to incite racial hatred, discriminatory, blasphemous, in breach of confidence or in breach of privacy;

(d) would bring us, or the Services, into disrepute;

(e) impersonates any person or entity or otherwise misrepresents your affiliation with a person or entity, including us.

4.4 We reserve the right to monitor your use of the Services.

- ACCOUNT INFORMATION & WARRANTIES

5.1 It is your responsibility to ensure that your Service Provider holds correct Account Information.

5.2 We do not check the accuracy of the Account Information retrieved from your Online Account and rely on you and your account provider ensuring that your Account Information is accurate.

5.3 You represent and warrant that: (a) you possess the legal authority to provide all relevant Account Information to us (e.g. you must be a/the relevant account holder and you have the permission of any joint or other account holders); (b) you will at all times comply with all relevant laws and regulations; and (c) causing your Account Information to be provided to your Service Provider is not misleading.

5.4 If you authorise a Third Party Provider (third party supplying goods or services to you other than Service Provider) to use our Services, you acknowledge and understand that we will provide the Third Party Providers with access to your Account Information. We are not responsible for the use of your Account Information by your Service Provider or any Third-Party Providers.

- INTELLECTUAL PROPERTY RIGHTS

6.1 Our Services contains intellectual property which is owned by or licensed to us and is protected by Australian, New Zealand and international laws, including but not limited to the trademarks, trade names, software, content, design, images, graphics, layout, appearance, layout and look of our Services.

6.2 You agree that, as between you and us, we own all intellectual property rights in the Services, and that nothing in these End User Terms constitutes a transfer to you of any intellectual property rights.

- PRIVACY

7.1 We will collect, use and disclose any personal information in accordance with our privacy policy available here, and in accordance with the Privacy Act 1988 (Cth) in Australia and the Privacy Act 1993 (NZ) and any other applicable privacy laws, including any determination, code or guideline issued under those laws in the relevant territory (Privacy Laws).

7.2 You must ensure that your disclosure of User Information to us complies with all relevant Privacy Laws.

- TERMINATION & SUSPENSION

8.1 Without limiting any other rights under these End User Terms, a party may terminate this agreement by written notice if the other party breaches any provision of these End User Terms and fails to remedy the breach within 20 days' written notice.

8.2 We reserve the right to deny or suspend your access to the Services at any time, for any reason whatsoever (including any breach of these End User Terms), at our absolute discretion. Where it is possible for us to contact you directly, we will notify you of any suspension or termination and the reasons for it.

8.3 On termination or expiry of this agreement: (a) each licence granted by us in respect of the Services also terminates; (b) you must immediately cease using the Services and delete copies of our Confidential Information; and (c) we will delete your User Information, except to the extent we're required by law to retain it, or have the right to retain it under any rights granted to us through our Privacy Policy.

- CHANGES AND MODIFICATIONS

9.1 We may amend the End User Terms from time to time in our sole discretion by publishing an updated version of the End User Terms on the Website. You should check the End User Terms regularly, prior to using the Website, to ensure you are aware of any changes, and only proceed to use the Website if you accept the new End User Terms. Your continued use of our Services following any amendments indicates that you accept the amendments.

9.2 We reserve the right to change or discontinue, temporarily or permanently, any Services at any time without notice, and without liability to you. If we cancel any Service (where such cancellation is not due to your acts or omissions or breach of the End User Terms) we will endeavour to provide you 1 week's notice.

- LINKS

10.1 Our Services may contain links to websites owned by third parties. We do not control, recommend, endorse, sponsor or approve third party websites, including any information, products or services mentioned on those third party websites, and are not liable in any way for your access to those links.

- DISCLAIMER & LIABILITY

11.1 While we use reasonable efforts to provide the Services in accordance with their stated description, you acknowledge the following (to the extent permitted by law and subject to clause 11.2):

(a) The Services are provided strictly on an "as is" and "as available" basis;

(b) We exclude all liability to you for any:

(i) inaccuracy, incompleteness, or inappropriateness of the Services;

(ii) delay or unavailability of the Services, or the Services being out-of- date;

(iii) data loss or corruption, or any viruses or other harmful components associated with Services; and

(iv) use of the Services by you, including any decisions made or outcomes based on the Services

(c) We are not liable to you (whether in contract, tort, negligence or otherwise) for any loss of profit, revenue, anticipated savings, goodwill, reputation or opportunity, or any other indirect or special loss or damage; and

(d) To the extent we have any liability to you in relation to the Services or under these End User Terms (other than for our fraud, breach of clause 6 (Privacy) or under the indemnity in clause 12.2 ), our liability is limited to resupply of the Services or payment of the cost of having the Services supplied again.

11.2 You acknowledge that the Services may assist you in dealing with Institutions, but we are not providing you with any legal, taxation, financial or other advice about the suitability or appropriateness of any service and we express no opinion on any service or Institution.

- IMPLIED WARRANTIES

12.1 To the maximum extent permitted by law, and subject to clause 11.2, any representation, warranty, condition, guarantee or undertaking that would be implied into these End User Terms by legislation or otherwise is excluded.

12.2 Nothing in these End User Terms excludes, restricts or modifies any consumer guarantee, right or remedy conferred on you by Consumer Law or any other applicable law that cannot be excluded, restricted or modified ('Non-Excludable Obligation'). However to the fullest extent permitted by law, our liability for a breach of a Non-Excludable Obligation is limited, at our option, to the cost of supplying the Services again or payment of the cost of having the Services supplied again.

12.3 For the purposes of the above, 'Consumer Law' means (a) in Australia, as set out in Schedule 2 of the Competition and Consumer Act 2010 (Cth); and (b) in New Zealand, as set out in the Fair Trading Act 1986 (NZ) and the Consumer Guarantees Act 1993 (NZ).

- INDEMNITY

13.1 You indemnify us from any Third Party Claims against us which arise due to your breach of the End User Terms.

13.2 We indemnify you from any Third Party Claims against you which arise due to our Services infringing a third party's intellectual property rights (other than due to your User Information, or any acts or omissions by you). If our Services are alleged to infringe a third party's intellectual property rights, we may, at our sole option and expense, elect to modify or replace the Services so they are non- infringing, or cancel supply of the Services and terminate this agreement. To the extent permitted by law, this clause states our sole liability, and your sole remedy, with respect to our Services infringing a third party's intellectual property rights.

13.3 Each party's liability under an indemnity is reduced to the extent that liability was caused or contributed by the other, and an indemnified party must: (i) promptly give written notice to the indemnifying party of the Third Party Claim; and (ii) allow the indemnifying party to conduct the defence and settlement of that claim (provided the indemnified party is not detrimentally impacted.

13.4 For the purposes of this clause 'Third Party Claim' means any claim, suit, action or demand by a third party, and will include any directly related liability, cost, damage or expense (including a fine or penalty imposed by a regulator).

- CONFIDENTIALITY

14.1 Each party must (unless expressly agreed otherwise): (a) use Confidential Information only for the purposes of the Services including in the case illion, disclosure to the relevant illion Customer; and (b) keep confidential all Confidential Information and only disclose Confidential Information of the other party to its Personnel who need to know for the purposes of providing the services.

14.2 The confidentiality obligations in clause 13.1 do not apply to information that: (a) is or becomes legally in the public domain at the time of disclosure without a breach of clause 13.1; (b) is legally obtained from a third party; (c) was in already in the possession of a party at the time of disclosure without any associated obligation of confidentiality; (d) has been independently developed by a party; or (e) is required to be disclosed by law or the rules of a stock exchange.

14.3 For the purposes of this clause, 'Confidential Information' means all information that could be reasonably regarded in the circumstances as confidential and not part of the public domain, including, without limitation, information relating to the terms of this agreement or a party's business affairs.

- FORCE MAJEURE

15.1 Neither party shall be liable for non-performance or delays caused by an external event beyond the reasonable control of a party, including, without limitation, acts of war, terrorism, cyber or data security attack, civil commotion, epidemic, natural disasters, blockades, embargoes, strikes and lockouts, any other acts of god or act of any government or governmental agency (Force Majeure Event). If the Force Majeure Event continues for a period of 60 days or more, the party not relying on the Force Majeure Event may terminate the affected agreement.

- NOTICES

16.1 You agree that any notices or other communications may be provided to you electronically via a notice on the Website, or via the email you have provided as part of the registration process. You may send notifications to us in relation to your use of the System via odssupport@illion.com.au.

- GENERAL

17.1 (Assignment) A party must not assign or novate this agreement, except with the prior written permission of the other party (not to be unreasonably withheld). However we may assign our rights or novate this agreement to any of our group companies or in connection with a merger or consolidation involving us or the sale of substantially all of our assets.

17.2 (Severability) If any part of these terms is illegal or unenforceable, it will be severed from these terms and the remaining terms will continue in full force and effect.

17.3 (Delay) No delay or failure by either party to exercise a right under these terms prevents the exercise of that right or any other right on that or any other occasion.

17.4 (Survival) Any provision of these End User Terms which is by its nature a continuing obligation will survive termination of these End User Terms (eg clause 10 (Disclaimer & Liability) clause 11 (Implied Terms) and clause 12 (Indemnity)).

17.5 (Laws) These End User Terms are governed by the laws of Victoria, Australia (when you are accessing Services via a ".com.au" Website), and the laws of New Zealand (when you are accessing the Services via a ".co.nz" Website).

Privacy Policy

Last Update: 8th June 2018

illion Privacy Policy

illion Open Data Solutions recognises the importance of protecting Personal Information about individuals. This Privacy Policy explains how illion Open Data Solutions collects, uses and disclosures Personal Information about you.

- Introduction

1.1 This Privacy Policy applies to the collection, use and disclosure of Personal Information that you provide to illion Open Data Solutions or authorise illion Open Data Solutions to collect. By accessing the illion Open Data Solutions Website and/use using our Services you agree to be bound by this Privacy Policy.

1.2 Capitalised terms used in this Privacy Policy have the meaning given to them in clause 14.

- Changing this Privacy Policy

2.1 This Privacy Policy may be amended from time to time, by publishing an updated Privacy Policy on the illion Open Data Solutions Website. Any subsequent access to or use by you of the illion Open Data Solutions Website will constitute an acceptance of the amended Privacy Policy. You should check from time to time to see if any part of this Privacy Policy has been updated.

2.2 This Privacy Policy does not limit our rights and obligations under relevant Privacy Laws.

- Personal Information we collect

3.1 We may collect the following Personal Information from or about you, where the information is reasonably necessary for our business purposes and to provide our Services to you:

• Name

• Address

• email address

• mobile number

• date of birth

• Bank Credentials;

• financial information from your Bank (including bank statements and other financial data);

• payment details (for example credit card, debit card or PayPal);

• opinion (we may conduct surveys or market research to seek your opinion and feedback; and

• other relevant personal and/or demographic information.

- How we collect your personal information

4.1 Normally we collect information from you directly, unless it is unreasonable or impracticable to do so. We may also collect information about you from third parties (eg your Bank or Third Party Institution), our contractors who supply services to us, through referrers from a publicly maintained record or from other individuals or companies as authorised by you.

4.2 Personal information about you may be collected by us in a number of circumstances, including if you (a) use our Services; (b) register with us; (c) lodge an enquiry with us by email or telephone; (d) apply to work with us; or complete any surveys that we issue.

4.3 From time to time we may collect, use, store and disclose nonidentifiable information relating to your use of the illion Open Data Solutions Website. For example, we may record information such as the areas of the illion Open Data Solutions Website that you visit along with the time, date and URL of the pages you access, your IP address and/or the previous website that you visited before linking to the illion Open Data Solutions Website.

- Purpose of collection of Personal Information

5.1 We collect Personal Information for the primary purpose of being able to operate our business, including to provide our Services to you. If you do not provide all of the Personal Information we request (or authorise us to collect that information), you may not be able to use our Services.

5.2 In addition, we collect your Personal Information so we can carry out the following actions:

• to validate, update and /or enhance our products, services and databases (including those of our Related Bodies Corporate);

• to verify and assess your identity;

• to undertake research, analytics and/or benchmarking;

• to identify and understanding user needs, and for our business development and marketing purposes;

• to send you details about products and services and special offers that might interest you, from us and from third parties – see clause 10 below; and

• internal record keeping, audit and compliance purposes and to comply with our legal and regulatory obligations.

5.3 We will not use your Bank Credentials other than to provide the Services to you.

- Disclosure & Use of Personal Information

6.1 You authorise us to disclose Personal Information to: (a) Your Bank - we disclose the information that you provide to us (including your Bank Credentials) to your Bank to access your financial information; (b) Your Third Party Institution – we disclose the financial information extracted from your Bank to your Third Party Institution; and (c) Other – (i) our employees, contractors or service providers, to the extent reasonably necessary to fulfil our obligations to you; (ii) anyone considering acquiring an interest in our business or assets; (iii) other entities or persons (including our Related Bodies Corporate) to the extent reasonably necessary for the Purposes set out in clause 5.2 above; (iv) any law enforcement, legal, government or regulatory agency, where such disclosure is required or authorised by law; (v) other individuals or companies authorised by you.

6.2 The collection, use, storage and disclosure of personal information by your Bank and your Third Party Institution will be subject to the privacy policies of those organisations. We do not control and are not responsible for any use of personal information by your Bank or Third Party Institution.

6.3 In order to provide services to you, we may also need to acquire specialised services from other related entities within the illion group (illion Group Members). You acknowledge that we may transfer information about you to illion Group Members as reasonably necessary to receive those intra-group services. Each illion Group Member will hold and use that information in accordance with its own privacy policy.

- Sending information overseas

7.1 Some of the entities we disclose to may be located overseas. The countries in which recipients are likely to be located are Australia and New Zealand.

7.2 We will not send your personal information to countries other than those identified in clause 7.1 above without obtaining your consent or otherwise complying with the Australian Privacy Principles.

- Provision of information about others

8.1 Please be aware that the End User Terms prohibit the use of our Services on behalf of any other person. We will not ask you to provide us with information about someone else. However, if you provide unsolicited Personal Information to us about someone else, you must ensure that you are authorised by the relevant individual to disclose their Personal Information to us for the purpose for which it is provided.

- Use of Cookies

9.1 We may use technology known as a "cookie" to collect statistical information about you when using internet browsing, mobile or tablet applications. Cookies are small pieces of information captured when your device is used to access online content. They can record information about your visit to the illion Open Data Solutions Website, allowing it to remember you the next time you visit and provide a more meaningful experience.

9.2 You can switch off cookies by adjusting the settings on your web browser. If you disable the use of cookies on your web browser or remove or reject specific cookies from the illion Open Data Solutions Website then you may not be able to gain access to all of the content and facilities on the illion Open Data Solutions Website.

9.3 We allow Participating Lenders and their service providers to also use cookies on our site to track performance.

- Direct Marketing

10.1 From time to time we may use your personal information that you have provided to us to provide you with: updates about your information; and current information about our services, special offers you may find of interest, changes to our organisation, or new products or services being offered by us or any third party (Marketing Communications).

10.2 By providing us with your personal information, you consent to us (including our Related Bodies Corporate) using your information to contact you on an ongoing basis for these purposes, including by mail, email, SMS, social media and telephone.

10.3 If you do not wish to receive Marketing Communications form us, you may at any time unsubscribe from receiving such information by responding via the channel in which you received the marketing communication. We will not charge you for giving effect to your request and will take all reasonable steps to meet your request at the earliest possible opportunity.

10.4 You acknowledge and agree that even if you opt out of receiving Marketing Communications, we will still send you essential information that we are required to send you relating to the Services we provide.

- Storage & Security

11.1 We will use all reasonable endeavours to keep your personal information in a secure environment, however, this security cannot be guaranteed. Our procedures are designed to prevent your personal information being accessed by unauthorised personnel, lost or misused. If you reasonably believe that there has been unauthorised use or disclosure of your personal information, please contact us using the contact details below.

11.2 Notwithstanding the reasonable steps taken to keep information secure, breaches may occur. In the event of a security incident we have in place procedures to promptly investigate the incident and determine if there has been a data breach involving personal information, and if so, to assess if it is a breach that would require notification. If it is, we will notify affected parties in accordance with Privacy Act requirements.

- Your access to your Personal Information

12.1 It is important to our relationship that the personal information we hold about you is accurate and up to date.

12.2 You may request access to any of the personal information we hold about you at any time. To request access to the personal information that we hold about you, use the contact details specified below. We may charge a fee for our reasonable costs in retrieving and supplying the information to you.

12.3 If you consider that any information we hold about you is incorrect, you should contact us to request that it is updated. Please let us know if there are any changes to the personal information you have provided to us. While we take reasonable steps to ensure that the personal information held by us is up to date, we will generally rely on you to assist us in informing us if the information we hold about you is inaccurate or incomplete.

12.4 We will respond to your request within a reasonable period of time and, where reasonable and practicable, grant access to the information in the manner requested. An explanation will be provided to you if we deny you access to your personal information we hold.

- Further information and complaints

13.1 You may request further information about the way we manage your Personal Information or lodge a complaint by contacting us using the contact details below.

13.2 We will deal with any complaint by investigating the complaint, and providing a response to the complainant within 30 business days, provided that we have all necessary information and have completed any investigation required. In cases where further information, assessment or investigation is required, we will seek to agree alternative time frames with you.

- Definitions and interpretation

• Bank means your relevant bank or financial institution, the details of which you provide to us.

• Bank Credentials means your Bank account username and password.

• End User Terms means the illion Open Data Solutions End User Terms available at ILLION END USER TERMS.

• Personal Information means personal information (as defined in the relevant Privacy Laws) that you provide to illion Open Data Solutions or authorise illion Open Data Solutions to collect.

• Privacy Laws means the Privacy Act 1988 (Cth) when the Territory is Australia, and the Privacy Act 1993 (NZ) when the Territory is New Zealand, and any other applicable privacy laws, including any determination, code or guideline issued under those laws in the relevant Territory.

• Privacy Policy means this privacy policy, as amended from time to time.

• illion Open Data Solutions (also referred to as "us", "we" and "our") means illion Open Data Solutions Pty Ltd ACN 166 277 845 (an illion group company) and also (a) illion Australia Pty Ltd (ABN 95 006 399 677) where you are accessing the Website via ".com.au", or (b) illion New Zealand Marketing Services Limited (Co. No. 6398759) where you are accessing the Website via ".co.nz"

• illion Open Data Solutions Website means:

i. https://www.illion.com.au/;

ii. https://bankstatements.com.au/;

iii. https://www.illion.com.au/risk-marketing-solutions/open-data-solutions/bankfeeds/;

iv. https://proviso.co.nz/;

v. https://bankstatements.co.nz/;

vi. https://proviso.co.nz/bankfeeds/; or

vii. other channels that allow you to access our Services.

• Related Body Corporate means (a) where the Territory is Australia – the meaning given to that term in section 9 of the Corporations Act 2001; and (b) where the Territory is New Zealand – the meaning given to "Related Company" in section 2(3) of the Companies Act 1993.

• Services means the illion Open Data Solutions services described in the End User Terms.

• Territory means (a) Australia, if you are accessing Services via a ".com.au" illion Open Data Solutions Website; or (b) New Zealand, if you are accessing Services via a ".co.nz" illion Open Data Solutions Website.

• Third Party Institution means the third party business that provides credit, credit assistance or other services to you, and in relation to which you are accessing our Services.

- How to contact us

15.1 Please contact us on admin@proviso.com.au if you have any questions about the illion Open Data Solutions Website, this Privacy Policy or any of our Services.

Line of Credit Product

You are applying for Freestyle The Virtual Credit Account, which is a revolving line of credit. This product allows you to draw up to an approved limit, and re-borrow again up to the approved limit once you pay the limit down. This product has a credit limit of between $1,000 and $20,000, and a loan term up to 60 months for each drawdown. You do not have to provide any security. There is an annual fee of $0 and $149, and a monthly fee of $5 if your outstanding balance is over $20. Please do not proceed unless this product meets your requirements and objectives.

Medium Amount

Loan Product

You are applying for a MoneyMe Medium Amount Loan. This product has a credit limit between $2,001 and $3,000, and a loan term between 12 and 24 months. You do not have to provide any security. There is an establishment fee of $295, a $10 monthly fee, but no annual fee. Please do not proceed unless this product meets your requirements and objectives.

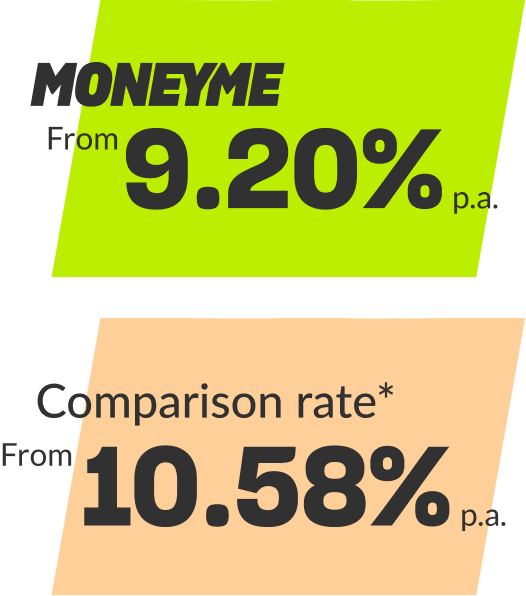

Personal Loan Product

You are applying for a MoneyMe Personal Loan. This product has a credit limit between $5,000 and $50,000, and a loan term between 12 and 60 months. You do not have to provide any security. There is an establishment fee between $395 - $495 depending on the credit limit, a $10 monthly fee, but no annual fee. Please do not proceed unless this product meets your requirements and objectives.

Important note

Please note that to afford to repay this loan, you will need to reduce your discretionary spending. We have assumed that reducing your discretionary spending to obtain this loan meets your requirements and objectives. If it does not, you should not proceed with the loan. If you are unsure, you can contact us on 1300 669 059

Personal Loan Product

You are applying for a MoneyMe Personal Loan. This product has a credit limit between $2,000 and $35,000, and a loan term between 12 and 60 months. You do not have to provide any security. There is an establishment fee of 10% of the credit limit, a $15 monthly fee, but no annual fee. Please do not proceed unless this product meets your requirements and objectives.

MoneyMe+ Product

You are applying for MoneyMe+, which is a revolving line of credit. This product allows you to draw up to an approved limit and re-borrow again up to the approved limit once you pay the limit down. This product has a credit limit of between $5,000 and $50,000, and a loan term up to 60 months for each drawdown. You do not have to provide any security. There is an administration fee of $49 or more for each purchase and a monthly fee of $5 if your outstanding balance is over $20. Please do not proceed unless this product meets your requirements and objectives.

Personal Loan Product

You are applying for a MoneyMe Personal Loan for the purpose of debt consolidation. This product has a credit limit between $5,000 and $50,000, and a loan term between 12 and 60 months. You do not have to provide any security. There is an establishment fee between $395 - $495 depending on the credit limit, a $10 monthly fee, but no annual fee. Please do not proceed unless this product meets your requirements and objectives.

5Applications and maximum credit limits are subject to eligibility criteria including credit approval. Other terms and conditions may apply. 6Conditions apply to the interest free period. Refer to the Terms and Conditions for the Account for further information. After the interest free period, an interest rate of 18.74% p.a. to 23.74% p.a. will apply. 7The actual rate that you receive will depend on a range of factors, including your credit score.

Apple Store is a trademark of Apple Inc., registered in the U.S. and other countries. The card facility is issued by EML Payment Solutions Ltd pursuant to license by Mastercard Asia/Pacific Pte. Ltd. Mastercard and the Mastercard brand mark are registered trademarks, and the circles design is a trademark of Mastercard International Incorporated.

*The $250 credit back offer is available when you apply and are approved for a new Freestyle Virtual Credit Account from 7 October 2022 to 31 December 2022 (inclusive) and spend $1,000 on eligible purchases within 12 months of card approval. Eligible purchases do not include fees, cash, cash equivalent transactions or illegal transactions, payments to charities, social service, and government agencies, payments for proprietaries and sundries, streaming subscriptions, recurring payments or memberships, gambling, adult dating or escort services and refunds debited from the Freestyle Virtual Credit Account. The $250 credit back will be paid as a statement credit to your Freestyle Virtual Credit Account within 3 days of meeting the minimum spend criteria. Existing Freestyle customers who currently hold a Freestyle Virtual Credit Account are not eligible for this offer. The credit-back offer is limited to $250 per customer.

Loan details

For how long?

*The payment of .... does not include the $10.00 monthly account fee. Total repayments ...., made up of an establishment fee of ...., interest of .... and monthly account keeping fees of ..... The repayment amount is based on the variables selected, is subject to our assessment and suitability, and other important terms and conditions apply. To view our costs in detail, scroll to bottom of page.**

Troubleshooting tips

Use the same login ID and password

you use for your online banking

Please try clearing your cache, refresh the page and try again. If the problem continues please try using a different browser or device.

To ensure your details are correct, try logging in to your online banking via your bank's website. If they're correct; try clearing your cache, refresh the page and try again.

FAQ

You’ll need to log in with the same details used when logging into your internet banking website.

Please note, your password is not your PIN that is used when logging in from your mobile app.

The best way to ensure you’re using the correct details is to firstly log in to your internet banking through your bank’s website. Once confirmed, return to this page and try again.

Please clear your cache, refresh the page and try again. If the issue remains, please try a different device or contact us on 1300 669 059.

We are required by law to make an assessment that a loan contract is not unsuitable to you. We obtain a copy of 90 days of your most recent bank statements to make this assessment.

We may also access your bank statements during the life of your loan for account management purposes, for example if you default on repayments. We access your recent bank statements through a highly secure platform operated by our trusted partner illion - the same technology used by a number of big banks and online companies. This means you can avoid all the messy and time-consuming admin of getting your bank statements and pay slips to us.

It is not possible for us to see or access your online banking password.

Unfortunately if your bank is not on the list, it’s likely we’ll be unable to proceed with your application.

No, only Australian residents are eligible to apply for a loan.

Please select the bank account that your income is paid into. If you have changed banks over the past 90 days you may have to do a second submission, choosing your previous bank. Please note that if you hold multiple accounts with the same bank, your account statements for each of those accounts may be automatically provided to us.

What does this

technology do?

We take a 90-day snapshot of your bank statements

No person has access to your bank account ensuring your info is safe

Notice

Before applying for a loan, you should consider alternative methods of funding the stated purpose

Your schedule

Date

Amount

1

15/03/2017

$64.74

2

22/03/2017

$64.74

3

29/03/2017

$64.74

4

05/04/2017

$64.74

5

12/04/2017

$64.74

6

19/04/2017

$64.74

7

19/04/2017

$64.74

78

19/04/2017

$64.74

Application complete!

We’ll be in touch soon.

Redirecting you to your Member's Area...

Passcode updated!

Redirecting you to your Member's Area...

Scroll to bottom

To e-sign and finalise your application,

scroll down and tap confirm

IMPORTANT

BEFORE YOU SIGN

- READ THIS CONTRACT DOCUMENT so that you know exactly what contract you are entering into and what you will have to do under the contract.

- You should also read the information statement: ‘THINGS YOU SHOULD KNOW ABOUT YOUR PROPOSED CREDIT CONTRACT’.

- Fill in or cross out any blank spaces.

- Get a copy of this contract document.

- Do not sign this contract document if there is anything you do not understand.

THINGS YOU MUST KNOW

- You can withdraw this offer at any time before the credit provider accepts it. When the credit provider does accept it, you are bound by it. However, you may end the contract before you obtain credit, or a card or other means is used to obtain goods or services for which credit is to be provided under the contract, by telling the credit provider in writing, but you will still be liable for any fees or charges already incurred.

- You do not have to take out consumer credit insurance unless you want to. However, if this contract document says so, you must take out insurance over any mortgaged property that is used as security, such as a house or car.

- If you take out insurance, the credit provider can not insist on any particular insurance company.

- If this contract document says so, the credit provider can vary the annual percentage rate (the interest rate), the repayments and the fees and charges and can add new fees and charges without your consent.

- If this contract document says so, the credit provider can charge a fee if you pay out your contract early.

Please note this page forms part of your loan agreement

Your e-signature

Scroll to bottom

To e-sign and finalise your application,

scroll down and tap confirm

IMPORTANT

BEFORE YOU SIGN

- READ THIS CONTRACT DOCUMENT so that you know exactly what contract you are entering into and what you will have to do under the contract.

- You should also read the information statement: ‘THINGS YOU SHOULD KNOW ABOUT YOUR PROPOSED CREDIT CONTRACT’.

- Fill in or cross out any blank spaces.

- Get a copy of this contract document.

- Do not sign this contract document if there is anything you do not understand.

THINGS YOU MUST KNOW

- You can withdraw this offer at any time before the credit provider accepts it. When the credit provider does accept it, you are bound by it. However, you may end the contract before you obtain credit, or a card or other means is used to obtain goods or services for which credit is to be provided under the contract, by telling the credit provider in writing, but you will still be liable for any fees or charges already incurred.

- You do not have to take out consumer credit insurance unless you want to. However, if this contract document says so, you must take out insurance over any mortgaged property that is used as security, such as a house or car.

- If you take out insurance, the credit provider can not insist on any particular insurance company.

- If this contract document says so, the credit provider can vary the annual percentage rate (the interest rate), the repayments and the fees and charges and can add new fees and charges without your consent.

- If this contract document says so, the credit provider can charge a fee if you pay out your contract early.

Please note this page forms part of your loan agreement

Your e-signature

Bond paid

Good luck with the move and

enjoy your new home

Account already exists

This email/mobile number is already

associated with a MoneyMe+ account.

Account doesn't exist

It doesn't appear that you have a MoneyMe+ account.

Please create a new account to complete your purchase.

Loading

1300 669 059

1300 669 059