You’ve received this payment from a

Freestyle virtual Mastercard

| Commbank | within 1 hour |

| Major banks | within 4 hours |

| Big institutions | within 1 business day |

| Small institutions | Next business day |

Up to $20,000

Lower rate 18.74% p.a. & $250 credit back*

*$250 is credited back to your account when you spend a minimum AUD$1,000 on purchases using your Freestyle Virtual Mastercard®. Eligible for applications made from 01/09/2020 for a limited time only.

View full T&C’s here.

The AUD$250 credit back offer is available for a limited time only when you apply and are approved for a new Freestyle Virtual Credit Account from 1st of September 2020 and spend A$1,000 on eligible purchases within 12 months of card approval. Eligible purchases do not include fees, cash, cash equivalent transactions or illegal transactions, payments to charities, social service and government agencies, payments for proprietaries and sundries, streaming subscriptions, reoccurring payments or memberships, gambling, adult dating or escort services and refunds debited from the Freestyle Virtual Credit Account. The A$250 credit back will be paid as a statement credit to your respective Freestyle Virtual Credit Account within 3 days of meeting minimum spend criteria. Existing Freestyle customers who currently hold a Freestyle Virtual Credit Account, are not eligible for this offer. The credit back offer is limited to $250 per customer.

Close

A low rate from 18.74% p.a. to 23.74% p.a.* applies thereafter.

*The actual rate that you receive will depend on a range of factors, including your credit rating

Limit

Up to $20,000**

Annual fee

Monthly fee

Interest-free period

Up to 55 days*

Interest rate

A rate from 18.74% p.a. to 23.74% p.a. (based on your credit score) applies thereafter7

*A low rate from 18.74% p.a. to 23.74% p.a. applies thereafter. The actual rate that you receive will depend on a range of factors, including your credit rating.

**Applications are subject to eligibility criteria including credit approval. Other terms and conditions may apply.

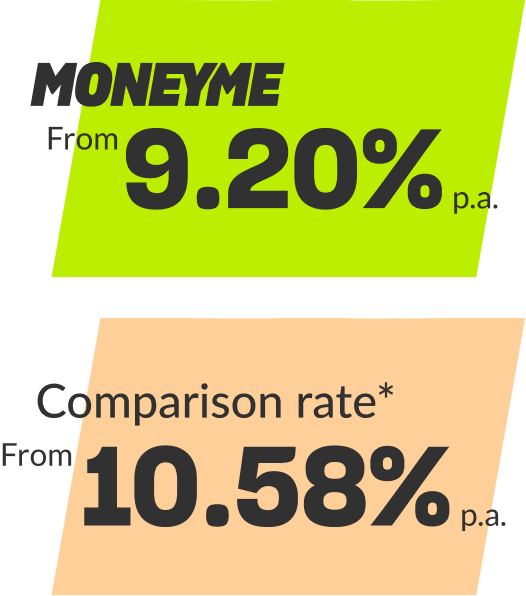

*This comparison rate is based on an unsecured variable rate personal loan of $30,000 for a term of 5 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. $495 establishment fee and $10 monthly fee applies. Comparison as of: 13/07/2023

The difference between your current annual fee and this new annual fee will be payable on a pro rata basis until the next annual anniversary date of your account being approved.

From the next annual anniversary date of your account being approved, the full new annual fee will be payable.

Note that your annual fee is payable by you in equal instalments over the year on the same days that your repayments are due as specified on your statements of account.

Payable from the next annual anniversary date of your account being approved.

Note that your annual fee is payable by you in equal instalments over the year on the same days that your repayments are due as specified in your statements of account

The method of calculating your minimum repayments will change in respect of any drawings made after the variation to the credit limit is implemented, so that any amount utilised within your credit limit will be spread out over a new agreed term of months.

Your current repayment terms will continue to apply to drawings made before the change to the credit limit is implemented.

I'm new here

I already have an account

I'm new here

I already have an account

We're connecting with your bank...

This may take up to 60 seconds

Please bear with us while we download your 90 day bank history. This may take longer depending on your bank.

We have detected that you have been idle for 300 seconds.

You will be logged off in seconds.

Further information on how to activate MoneyMe Express Visa card will be sent to you with your card. Terms and conditions and fees and charges will apply to your use of the MoneyMe Express Visa card.

MoneyMe Pty Limited ABN 40 163 691 236 acts as authorised representative of Emerchants Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 as distributor of the MoneyMe Express Visa card. Cuscal Limited ABN 95 087 822 455, AFSL 244116 is the issuer of the product. Any advice is general advice that does not take account of your objectives, financial situation or needs, so you should consider whether the product is suitable for you before acquiring or activating it. The product is available only to Australian resident MoneyMe members.

The link and verification code has been sent to your email.

The link and verification code has been sent to your mobile.

Verification code has been sent.

The verification link has been sent to your email.

The verification link has been sent to your mobile.

You selected that your future circumstances and

financial position may change.

Can you confirm if you are able to repay this loan?

WARNING: Do you really need a loan today?*

It can be expensive to borrow small amounts of money and borrowing may not solve your money problems.

Check your options before you borrow:

For information about other options for managing bills and debts, call 1800 007 007 from anywhere in Australia to talk to a free and independent financial counsellor.

Talk to your electricity, gas, phone or water provider to see if you can work out a payment plan.

If you are on government benefits, ask if you can receive an advance from Centrelink. www.humanservices.gov.au/advancepayments

The Australian Government's MoneySmart website shows you how small amount loans work and suggests other options that may help you.

*This statement is an Australian Government requirement under the National Consumer Credit Protection Act 2009

Uploading your bank statements

1300 669 059

1300 669 059